[Executive summary/TL;DR : A huge amount of cash was dumped into the economy with the 2020 COVID relief bill, which caused the burst in inflation. We have not yet returned to equilibrium (and lower inflation) but may by the end of 2024]

An interesting recession we are having, isn't it?

Earlier this year I stated a recession is coming, fortunately ignoring to tell you when it would happen. More than six months later there is no recession.

The Treasury bond market is not signaling a recession either as the entire yield curve continues marching higher. Thirty year mortgage rates continue rising, now over 7.5%, with no let up.

The most recent GDP numbers came out and still no recession, with a real growth GDP above 2.5%

Source: Federal Reserve

So what happened?

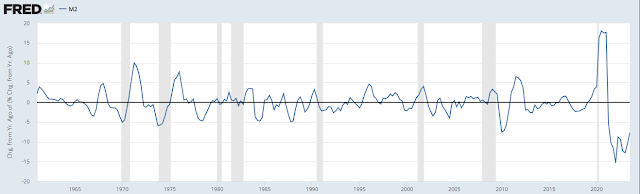

I think I found the reason, or perhaps, a reason. The US economy is an incredibly complex entity and there is not just one factor which pushes it around. I will be discussing just a few parts of it, so please keep that in mind. Now, take yourself back to the early parts of the COVID lockdown and hysteria. I know, a bad place to visit but sometimes finance blogging can be a scary place. In order to mitigate the lockdown, the COVID relief bill passed in early 2020 which dumped a massive amount of money into the economy, and when I mean massive, I mean unprecedented. Just look at this graph.

On a year over year basis M2 expanded around 17%, the largest spike in the entire data series.

To define for those who may not know, M2 is cash you have access to immediately.

Quoting the federal reserve:

M2 is a measure of the U.S. money stock that includes M1 (currency and coins held by the non-bank public, checkable deposits, and travelers' checks) plus savings deposits (including money market deposit accounts), small time deposits under $100,000, and shares in retail money market mutual funds.

Source: Federal Reserve

[Addendum added 11/20/23 - I should have included the massive increase in the Federal Reserve's balance sheet as another possible reason for the jump in M2. The relative importance of each (Federal Government or Federal Reserve) is not important for for the scope of this post, just that both had a factor in the spike. Looking at the graph below one can see just how massive the Federal Reserve expanded its balance sheet, roughly triple their response to the financial crisis of 2008/09. Currently the Federal Reserve is contracting their balance sheet and this is most likely the cause of the current reduction in M2.

Someone with more specialized knowledge regarding Federal Reserve balance sheet expansion and M2 wrote a detailed article regarding the interplay. --End Addenum]

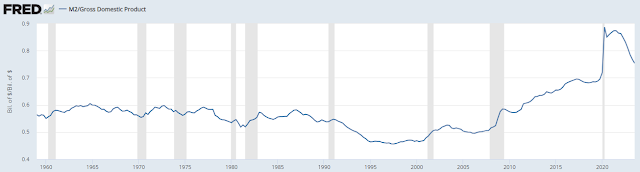

Now let us look at M2 as it compares to the US economy as a whole, expressed as GDP. As the real economy grows over time a slow increase in M2 is also needed, as it is how one facilitates the transactions which make up our economy. Observe the ratio of M2 to GDP (Gross Domestic Product, the sum of goods and services consumed domestically) Economist call the inverse of this 'monetary velocity'

Notice the massive spike in this fraction? Again, unprecedented.

Yes, that is a greater than 7 standard deviation move. Something that hasn't ever happened in modern US history.

So where did all that excess money go? Everywhere. Remember the AMC and Gamestop rip higher? Money from the sky, and bored people at home created that frenzy. Rolex prices? Yeah, that too.

Inflation hit soon after, the highest in decades.

Source: Federal Reserve

What gives me confidence to claim the rapid rise in M2 facilitated a rapid rise in inflation? Well, The Federal Reserve looked at this 30 years ago and noticed the causation.

Quoting from the above paper:

Over the three periods shown [30 years], the trend rate of growth of nominal GDP matches fairly closely the trend rate of growth of M2.

If velocity is stable, the rate of inflation will correspond over long periods of time to the excess of the rate of growth of money over output. To illustrate, over the three decades from 1960 through 1990, the excess of the annualized rate of growth of M2 (8.1 percent) over the annualized rate of growth of real GDP (3.0 percent) was 5.1 percent, while annualized inflation (measured by the implicit GDP price deflator) was 4.9 percent.

In short, the helicopter money shower in early 2020 resulted in a lot of the inflation we are seeing today.

Long term interest rates responded; gradually and then suddenly.

Source: Stockcharts

This is where I plead Mea Culpa to my clients. The standard signs where there; inverted yield curve, rising continuing claims, prices appeared to have bottomed (in late 2022), etc. so I started buying long duration Treasuries. I didn't think to look at the M2 growth, because it never changes too much. Until 2020. Whoops. Fortunately I only started nibbling on long term treasuries in late 2022, so the pain does not compare to someone who held them as a permanent part of their portfolio. Even now I am underweight my target bond allocation.

So what now? Considering my irrational desire to predict the future I posit the following; we are almost through this M2 money spike, we just don't know it yet.

Before the helicopter money drop the M2/GDP ratio was at ~0.70 and as of Q32023 ratio is at 0.75. The median absolute annual change in the ratio is 0.012 so as of today we are close (0.736 vs 0.75) to being back within the range of a 'normal' ratio. (Source at Federal Reserve) A combination of M2 reduction, economic growth, and inflation will most likely bring the ratio to within the normal range of variation by year end 2024.

So, we are mostly through the money storm now? Right? Well, maybe. Markets and economies have a tendency to swing well past their equilibrium points as they veer from one extreme to another. Considering just how much else is going on with the world I'm hesitant to make too many predictions with confidence. For now I've been building up my position in 90 day treasury bills instead of the long part of the bond market. When to buy more, well I don't quite know yet.

Ours is still a highly leveraged economy and the massive rise in funding costs for everyone in America as well as the inverted yield curve will eventually bite into economic growth. Right now we have two powerful forces pulling us in opposite directions; an excessive amount of money (M2) still sloshing around the economy versus a decelerating economy due to a massive increase in funding costs.

Additionally I believe this spike in M2/ GDP may have caused multiple active allocation strategies to fail as well. Some of these switch between equity market and Treasury bonds, but with the relentless inflation and subsequent bond market thrashing they have performed poorly. The M2 spike we've recently experienced hasn't ever happened before, so how do you model it? This is a facet of current finance, the impossible seems to keep happening with disturbing regularity.

additional reading:

https://twitter.com/steveanastasiou/status/1651059292089499649