This appetite for cheap Chinese exports, which had at one point seemed insatiable, means that we in the West have come to owe our largest Asian trading partner quite a hefty sum of money. China has become the world's biggest creditor, after amassing nearly $2.3 trillion of foreign exchange claims on us. However, the spectre of a creditor nation running persistent trade surpluses has ominous historical portents. It has happened only twice before, with the US economy in the Twenties and with the Japanese economy in the Eighties.Read the entire article, it is not long.

Friday, February 26, 2010

Hugh Hendry on China's chronic overcapacity and what it means.

Hugh Hendry once again nails it (in my opinion) as to what China's conversion into the workshop of the world really means.

Thursday, February 18, 2010

Consumer credit keeps contracting faster

Consumer credit data came out about 2 weeks ago and the numbers are not getting any better. Unlike my previous entries showing the very long term I thought I'd zoom in a little to show you how this recession is unlike anything we've seen in the last 40 years. Consumer credit keeps going down and the rate of declining is increasing. Call this an anti-'green shoot'.

The economy will not properly recover and the Federal Reserve will most likely not raise interest rates too much (if at all) until consumer credit and bank lending start rising. Until then, get used to very low short term rates.

The economy will not properly recover and the Federal Reserve will most likely not raise interest rates too much (if at all) until consumer credit and bank lending start rising. Until then, get used to very low short term rates.

Wednesday, February 17, 2010

Bank lending continues falling -- Are buying US Treasuries instead

Bank lending continues to fall on a year over year basis. Compared to the previous two recessions in which bank lending stabilized and then renewed growing this time overall bank lending is down and is continuing to decline.

As you can see from the first graph they are instead following the pattern from the last two recessions and are increasing the US Government securities portfolios while cutting lending to the private sector. Unlike private bank loans Treasuries are very liquid and can be sold immediately if cash is needed. Capital requirements for Treasuries are also much lower compared to a private bank loan. Considering the capital positions of most banks in America (I'll have a post on this soon) are tenuous they need the liquidity and 'safety' of Treasuries.

The year over year change in bank's holdings of US Government securities does not show the full extent of the bank Treasury purchases. As you can see from the second graph the banks continue to load up and the slope is definately upwards.

As you can see from the first graph they are instead following the pattern from the last two recessions and are increasing the US Government securities portfolios while cutting lending to the private sector. Unlike private bank loans Treasuries are very liquid and can be sold immediately if cash is needed. Capital requirements for Treasuries are also much lower compared to a private bank loan. Considering the capital positions of most banks in America (I'll have a post on this soon) are tenuous they need the liquidity and 'safety' of Treasuries.

The year over year change in bank's holdings of US Government securities does not show the full extent of the bank Treasury purchases. As you can see from the second graph the banks continue to load up and the slope is definately upwards.

Monday, February 15, 2010

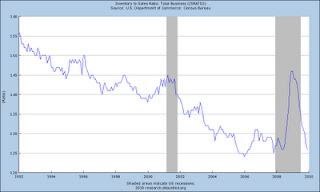

Inventory bounce is pretty much over with

The Inventory / Sales ratio is pretty much back to 'normal'. As such the inventory bounce contribution to GDP is over. A lot of other blogs have the details but here's one picture that says it all.

The quick and easy fixes to GDP growth have already occured. It's going to be tough sledding now.

The quick and easy fixes to GDP growth have already occured. It's going to be tough sledding now.

Friday, February 12, 2010

North Korea from another perspective

Ever since my previous posts on North Korea I have been on the lookout for more articles. The pathology of how the the authorities are able to completely twist and warp the nations reality is fascinating to me. Slate.com ran a recent article:

A Nation of Racist Dwarfs: Kim Jong-il's regime is even weirder and more despicable than you thought.

A Nation of Racist Dwarfs: Kim Jong-il's regime is even weirder and more despicable than you thought.

Consider: Even in the days of communism, there were reports from Eastern Bloc and Cuban diplomats about the paranoid character of the system (which had no concept of deterrence and told its own people that it had signed the Non-Proliferation Treaty in bad faith) and also about its intense hatred of foreigners. A black Cuban diplomat was almost lynched when he tried to show his family the sights of Pyongyang.Interesting reading . . .

Thursday, February 11, 2010

Copper update -- Nice to see I'm not alone in the wilderness

My bearish opinion of copper has been met with (polite) derision by some people. It is nice to see I'm not the only one who is very bearish on the metal

One of the Fast Money members took the very opposite viewpoint from Threlkeld but I find his reasoning incorrect. As I have mentioned in previous posts copper inventories continue to rise and new supply (TCK for example) is coming from various sources.

More on Threlkeld can be found in this Bloomberg article.

I haven't purchased BOS yet. I'm hoping for a bounce from the copper selloff to initiate my position.

One of the Fast Money members took the very opposite viewpoint from Threlkeld but I find his reasoning incorrect. As I have mentioned in previous posts copper inventories continue to rise and new supply (TCK for example) is coming from various sources.

More on Threlkeld can be found in this Bloomberg article.

I haven't purchased BOS yet. I'm hoping for a bounce from the copper selloff to initiate my position.

Wednesday, February 10, 2010

Hugh Hendry debating economists and ambassadors on the Euro and Greece. Loan sharking in the EU.

Hugh Hendry, in the guise of the evil speculator debates Stiglitz and the Spanish ambassador to the UK on the current situation in Greece. The Greek situation is a mess and in my opinion a 'bailout' would create a tremendous moral hazard. Ireland, Spain, and Portugal would all scream foul and demand their own cash / backstop. Only if the bailout includes draconian spending cuts and severe punishment for failure would it actually solve the problem. Considering we are talking about Greece which has a 200 year history of reneging on its debt the odds drop by quite a bit of a sucessful workout.

Even if you could get the Greeks to promise to spending cuts, would they follow through with it? The Germans (presumed donor) could agree to purchase Greek debt ONLY AFTER they cut their budget each and every year until the have a balanced budget. No balanced budget, no more debt buys by Germany. Perhaps the Germans could attach a percentage of EU funds flowing to Greece as their payment source?

Even better, take the title to a few Greek Islands as collateral. Don't pay up, you get an island (or 20 or so)

There's some great commentary afterwards at zerohedge on this debate. Go on over and check it out.

ht Zerohedge

Even if you could get the Greeks to promise to spending cuts, would they follow through with it? The Germans (presumed donor) could agree to purchase Greek debt ONLY AFTER they cut their budget each and every year until the have a balanced budget. No balanced budget, no more debt buys by Germany. Perhaps the Germans could attach a percentage of EU funds flowing to Greece as their payment source?

Even better, take the title to a few Greek Islands as collateral. Don't pay up, you get an island (or 20 or so)

There's some great commentary afterwards at zerohedge on this debate. Go on over and check it out.

ht Zerohedge

Monday, February 8, 2010

Fast Money needs to do their homework -- High lumber prices are due to a temporary supply shortage not demand

I was watching Fast Money on CNBC tonight and their Prop Desk blurb on lumber and by implication Plum Creek (PCL) caught my attention. The Fast Money speaker posited lumber prices had risen dramatically and this was a sign of a lumber and housing recovery.

I recently listened to the Plum Creek earnings report and management specifically commented upon weather conditions in the southeast US creating supply problems. To quote from a SeekingAlpha article:

Furthermore quite a few directors and officers of Plum Creek sold some of their holdings a few days after the earnings report:

I'm not disparaging Plum Creek or their officers / managers for selling off a small portion of their shares, but doesn't the comment about a short term weather phenomenon spiking lumber prices and quite a few officers unanimously selling their shares cause you to reconsider the short term valuation of the company?

I have followed Plum Creek on and off for several years and right now have a very small (just one contract) short call spread position on the company. It is a company I may very well own in the future if the price is right. Right now I do not foresee a strong housing rebound and my position is due to valuation issues. The price of both lumber and PCL have already had their run in my opinion.

I have followed Plum Creek on and off for several years and right now have a very small (just one contract) short call spread position on the company. It is a company I may very well own in the future if the price is right. Right now I do not foresee a strong housing rebound and my position is due to valuation issues. The price of both lumber and PCL have already had their run in my opinion.

My beef is with Fast Money. Do your homework. PCL may continue upwards for a little longer but it is riding high on a short term phenomenon. The price rise is due to weather and a short term supply disruption. Once the forests dry out they are going to cut cut cut and the relatively high prices of lumber will come crashing down.

p. s. I would not call lumber futures a 'secret sauce' unconventional indicator. It is a publicly traded futures contract available on stockcharts.com and everywhere else. The implication you are revealing your sekrets is vaguely insulting.

I recently listened to the Plum Creek earnings report and management specifically commented upon weather conditions in the southeast US creating supply problems. To quote from a SeekingAlpha article:

A lot of this lumber is filling inventories; it is concern over wet weather. As we mentioned, lot of these mills especially in the southern United States are very short inventory, and therefore there is not a lot of lumber inventory in the system.

I was down in Mississippi, Louisiana, and Arkansas last week, and what my guess is that half the forests are inoperable, and I don’t what it was like two months ago. I know they got some 9 inches of rain in one day. It’s a severe problem, and most areas you can’t operate in today. They need two or three or four weeks of dry weather so that we can get into a lot of these areas. That’s why inventories are so tight in that region. So it’s a huge issue.

Furthermore quite a few directors and officers of Plum Creek sold some of their holdings a few days after the earnings report:

CROWE BARBARA L 591For a total of 14,174 shares. No one purchased shares, all were sales. (Source)

JIRSA ROBERT J 224

TUCKER DANIEL L 251

HOLLEY RICK R 4,376

BROWN DAVID A. 611

HOBBS JOHN B 178

LINDQUIST THOMAS M 2,097

RICKLEFS HENRY K 582

Wilson Nancy L 254

KRAFT JAMES A 604

LAMBERT DAVID W 1,076

KILBERG JAMES A 1,275

NEILSON LARRY D 776

REED THOMAS M 655

FITZMAURICE JOAN K 624

I'm not disparaging Plum Creek or their officers / managers for selling off a small portion of their shares, but doesn't the comment about a short term weather phenomenon spiking lumber prices and quite a few officers unanimously selling their shares cause you to reconsider the short term valuation of the company?

I have followed Plum Creek on and off for several years and right now have a very small (just one contract) short call spread position on the company. It is a company I may very well own in the future if the price is right. Right now I do not foresee a strong housing rebound and my position is due to valuation issues. The price of both lumber and PCL have already had their run in my opinion.

I have followed Plum Creek on and off for several years and right now have a very small (just one contract) short call spread position on the company. It is a company I may very well own in the future if the price is right. Right now I do not foresee a strong housing rebound and my position is due to valuation issues. The price of both lumber and PCL have already had their run in my opinion.p. s. I would not call lumber futures a 'secret sauce' unconventional indicator. It is a publicly traded futures contract available on stockcharts.com and everywhere else. The implication you are revealing your sekrets is vaguely insulting.

Video from Russian Forum -- Various hedge fund managers discuss the world

A video from the recent Russian Forum. It's an hour+ but I suggest you watch it all.

http://2010.therussiaforum.com/news/session-video3/

Numerous topics are covered including, coal, energy, Russia, China, US Treasuries, Emerging versus Developed economies. Includes Hugh Hendry, one of my favorite money managers.

ht Zerohedge

http://2010.therussiaforum.com/news/session-video3/

Numerous topics are covered including, coal, energy, Russia, China, US Treasuries, Emerging versus Developed economies. Includes Hugh Hendry, one of my favorite money managers.

ht Zerohedge

Labels:

agriculture,

china,

coal,

energy,

hugh hendry,

oil

Wednesday, February 3, 2010

The "Lets beat up on China some more" post

I've been collecting some links and posts on China for a while and I thought I'd dump them all at once. The title may sound odd but right now China collapsing seems to be the chatter throughout the blogosphere.

I am very certain they are going to run into some serious problems but I'm not quite convinced it is about to collapse REAL soon. I have been waffling on this for some time as to when to sell of my final holdings China related and start shorting (where I can) My previous post on copper lays out a rather negative position but I really need to see some slowdown in Chinese lending year over year as well as some other concrete data points before I declare the China bubble is popping and go full bore.

Maybe the PIIGS issue in Europe will be the catalyst? Dunno. This is whats hard about investing.

Chanos talk on China

http://www.ritholtz.com/blog/2010/02/chanos-sees-overheating-and-overindulgence-in-china/

Previous Chanos interview on China

http://www.cnbc.com/id/35056774/site/14081545

Vitaliy Katsenelson

http://contrarianedge.com/2010/01/28/chinese-quest-for-shortcut-to-greatness/

http://www.businessweek.com/magazine/content/10_02/b4162030091917.htm

Patrick Chovanec is a treasure trove of all things China with some excellent analysis and further links to follow. Just read it all

http://chovanec.wordpress.com/

The obligitory video of an empty mall in China

http://video.iptv.org/video/1218530801

http://ftalphaville.ft.com/blog/2009/12/14/111176/china-the-heat-is-on/

Read this report. It's mind blowing how much of their GDP comes from raw investment. Yes, you can have too much.

http://www.pivotcapital.com/reports/Chinas_Investment_Boom_the_Great_Leap_into_the_Unknown.pdf

http://www.pekingduck.org/2009/12/chinas-asset-bubble/

I am very certain they are going to run into some serious problems but I'm not quite convinced it is about to collapse REAL soon. I have been waffling on this for some time as to when to sell of my final holdings China related and start shorting (where I can) My previous post on copper lays out a rather negative position but I really need to see some slowdown in Chinese lending year over year as well as some other concrete data points before I declare the China bubble is popping and go full bore.

Maybe the PIIGS issue in Europe will be the catalyst? Dunno. This is whats hard about investing.

Chanos talk on China

http://www.ritholtz.com/blog/2010/02/chanos-sees-overheating-and-overindulgence-in-china/

Previous Chanos interview on China

http://www.cnbc.com/id/35056774/site/14081545

Vitaliy Katsenelson

http://contrarianedge.com/2010/01/28/chinese-quest-for-shortcut-to-greatness/

http://www.businessweek.com/magazine/content/10_02/b4162030091917.htm

Patrick Chovanec is a treasure trove of all things China with some excellent analysis and further links to follow. Just read it all

http://chovanec.wordpress.com/

The obligitory video of an empty mall in China

http://video.iptv.org/video/1218530801

http://ftalphaville.ft.com/blog/2009/12/14/111176/china-the-heat-is-on/

Read this report. It's mind blowing how much of their GDP comes from raw investment. Yes, you can have too much.

http://www.pivotcapital.com/reports/Chinas_Investment_Boom_the_Great_Leap_into_the_Unknown.pdf

http://www.pekingduck.org/2009/12/chinas-asset-bubble/

Tuesday, February 2, 2010

Copper crossing the Rubicon. 90 days before copper Armageddon.

(edit 03/09/11) I have come out with a new article updating my bearish points on Copper

As I have mentioned before, copper inventory fundamentals support neither the current price nor the medium term price momentum.

In this somewhat longer post I'll lay out the case of how copper's fate will be decided within the next 90 days.

Inventories

The first chart shows recent inventory numbers for copper. Since the 4th quarter of 2009 inventories have steadily risen with only one week of net declines. During that time inventories have consistently climbed at an average of at least 1,600 metric tons a day.

Looking back, inventories peaked at ~ 548,000 tons at the LME during the height of the financial panic in February 2009. As of Friday, Jan 29, 2010 541,050 tons were sitting in the LME warehouses. Throughout the world total copper inventories have surpassed their 2009 peak.

Longer term whenever copper inventories got up to the levels we are seeing today copper prices were usually in the sub $1 dollar range versus the 3.00+ price we are seeing right now. (ht Wildebeests)

Technicals

Copper prices have dropped since the beginning of the year and has recently touched the 100 day moving average line. Unless there is a massive upsurge in the price of copper over the next few days it is likely the 20 day moving average will cross over the 50. I am hoping for a good solid bounce off this correction to initiate some short positions.

Seasonally copper is strongest during the first quarter of the year. I'm speculating this is due to industrial concerns ordering copper in anticipation of the needs for the coming year. (ht Spectrum Commodities) If copper inventories continue to build throughout the first quarter 2010, when the seasonal boost ends we could see a very nasty fall in the price of copper.

Seasonally copper is strongest during the first quarter of the year. I'm speculating this is due to industrial concerns ordering copper in anticipation of the needs for the coming year. (ht Spectrum Commodities) If copper inventories continue to build throughout the first quarter 2010, when the seasonal boost ends we could see a very nasty fall in the price of copper.As I have mentioned in previous posts all major copper mines appear to be up and running with no strikes or work stoppages. Only one BHP mine in Australia is running at reduced capacity and it is scheduled to return to full capacity by March 31,2010 (source)

Demand

Even the International Copper Study Group shows excess supply and low demand. http://www.icsg.org/images/stories/pdfs/presrels_2010_01.pdf

In the first 10 months of 2009, world usage is estimated to have decreased by 1% compared with that in the same period of 2008. Chinese apparent usage, which accounted for 40 % of world usage over this period, grew by 1.8 Mt (43%) and nearly offset an 18% decline in the rest of the world.* Usage in the EU-15 countries, Japan, and the United States, which combined accounted for about 29.5% of world usage, decreased by 21%, 31%, and 21%, respectively.Re read that quote. Copper usage increased by 43% in China but declined dramatically in the industrialized world. If China had not gone on its lending bender copper usage would be in the toilet. Even with the dramatic demand increase in China copper inventories still went up.

Previous posts here have revealed my opinion of the bubble forming in China. Tightening monetary conditions in China will not help short term copper demand.

The counter argument

I am watching copper inventories on a daily basis now waiting for an entry point to initiate my short positions. If copper inventories suddenly started going down instead of almost daily marching higher I would have to reconsider this thesis of a coming copper collapse. I do not consider current monetary policy by any of the major powers stimulative enough to counteract the current inventory overhang from either a demand creation or montary inflation perspective.

Weapon of Choice

So how do you trade this? For long only accounts you can try BOS. It is an ETN which tracks the daily inverse price of copper, aluminum, and zinc. Considering the high correlations of the three metals and the similar inventory situations it may be the best long way to trade this. There are some double inverse material etf's out there but I try to avoid the 2x leveraged etfs. The decay rate is too dramatic and chews into your returns too quickly.

If you can / are willing to short there are multiple ways to play this. Shorting FCX, PCU, TCK are some of the obvious methods, but shorting the country etfs of Australia (EWA), Chile (ECH), and Peru (EPU) would provide strong materials stock exposure. If commodity prices tank all three countries will experience severe financial distress.

Please look at http://www.debtdeflation.com/blogs/ for some data on how Australia's debt loads are setting it up for a financial crisis similiar to what America just experienced. Only the ravenous demand for raw materials by China kept it from experiencing a severe decline. If commodity prices drop Australia is toast.

I have not completed all of my studies on any of the companies or countries enough to recommend you short them. I am merely providing them as some ideas for further study by you.

Disclosure: As I don't know your financial situation, propensity for risk, tax situation, liquidity needs, or anything else about your financial situation this strategy may or may not be suitable for you. I am laying out an aggressive strategy that can backfire if what I foresee does not come about. Don't come crying to me if it doesn't work out. If it does, just give me credit and 2 and 20 :) I am currently neither long nor short any of the securities mentioned above but intend to purchase or short some or all of them in the near future.

Additional Reading

http://agmetalminer.com/2009/12/08/copper-which-way-next/

http://www.zerohedge.com/article/global-tactical-asset-allocation-commodities

http://www.zerohedge.com/article/copper-new-precious-metal

http://seekingalpha.com/article/185619-base-metals-correction-start-of-a-crash-or-a-bear-trap?source=commenter -- He has several good charts on how the commercial traders are also very short at this time.

(edit 03/09/11) I have come out with a new article updating my bearish points on Copper

http://merrillovermatter.blogspot.com/2011/03/this-is-not-copper-you-are-looking-for.html

Monday, February 1, 2010

Mortgage Delinquencies -- A real hockey stick graph

Mortgage delinquencies keep rising nationwide as reported by Freddie Mac & Fannie Mae (via Calculatedrisk blog)

Until the delinquency rate starts to fall I seriously doubt home prices or new home construction will do anything beyond stumble along.

One hidden benefit from all the loans going bad is pre payment speeds have sped up for various mortgage backed securities. I have noticed a bump in principal paydowns beyond normal and I think its all the mortgages being purchased out of pools by the GSE's. Considering I own a wad of leveraged inverse floaters at below par I'm happy with that.

Until the delinquency rate starts to fall I seriously doubt home prices or new home construction will do anything beyond stumble along.

One hidden benefit from all the loans going bad is pre payment speeds have sped up for various mortgage backed securities. I have noticed a bump in principal paydowns beyond normal and I think its all the mortgages being purchased out of pools by the GSE's. Considering I own a wad of leveraged inverse floaters at below par I'm happy with that.

Subscribe to:

Posts (Atom)