Barry Ritholtz clearly explains why this foreclosure mess is so important and how all the cutting of corners by the loan servicing organization has gotten completely out of control.

http://www.ritholtz.com/blog/2010/10/why-foreclosure-fraud-is-so-dangerous-to-property-rights/

I could try to paraphrase it but you really must read it ALL to understand why this scandal is more than just some 'goofed up paperwork'

http://www.marketwatch.com/story/bank-of-america-halts-all-foreclosure-wsj-2010-10-08?siteid=bnbh

Bank of America halts all foreclosures. This is a few days old but just the latest in a long march of banks who are calling a full halt to foreclosures.

BofA's sterling efficiency is demonstrated by them foreclosing on a house with no mortgage. Whoops!

http://www.businessweek.com/news/2010-10-07/man-who-had-no-mortgage-faced-foreclosure-anyway-ann-woolner.html

This is going to get worse before it gets better . . .

Showing posts with label mortgage. Show all posts

Showing posts with label mortgage. Show all posts

Tuesday, October 12, 2010

Wednesday, October 6, 2010

Foreclosure mess roundup

I have not commented on the foreclosure mess but considering how it may impact you, gentle reader, I thought it worthwhile to repeat.

In short, the mortgage processors and servicers did not keep a proper chain of custody and MBS Pool 'C' which believes they own the mortgage does not have the paperwork proving they purchased it from Loan Company 'A' which sold it to 'B', who packaged it up into MBS (Mortgage backed security) 'C', and Bank 'D' now owns said MBS.

Some people along that chain over ownership have been caught forging paperwork. It's a long and nasty tale that will remain stuck in the courts for a while.

If you know of someone who is going through foreclosure and they want to keep the house this is something to keep in mind. Talk to a lawyer about ensuring the bank has all the proper paperwork.

From the WSJ, October 4

http://www.mefeedia.com/video/33073666

Calculatedrisk blog:

http://www.calculatedriskblog.com/2010/10/nightly-mortgage-mess.html

Nakedcapitalism has posted several entries regarding this topic. Here's just one entry:

I don't do this nasty tale of cutting corners and deception any justice with this overview. Read all the links above for a fuller story.

In short, the mortgage processors and servicers did not keep a proper chain of custody and MBS Pool 'C' which believes they own the mortgage does not have the paperwork proving they purchased it from Loan Company 'A' which sold it to 'B', who packaged it up into MBS (Mortgage backed security) 'C', and Bank 'D' now owns said MBS.

Some people along that chain over ownership have been caught forging paperwork. It's a long and nasty tale that will remain stuck in the courts for a while.

If you know of someone who is going through foreclosure and they want to keep the house this is something to keep in mind. Talk to a lawyer about ensuring the bank has all the proper paperwork.

From the WSJ, October 4

First, the affidavits IndyMac used to file the foreclosure were signed by a so-called robo-signer named Erica A. Johnson-Seck, who routinely signed 6,000 documents a week related to foreclosures and bankruptcy. That volume, the court decided, meant Ms. Johnson-Seck couldn't possibly have thoroughly reviewed the facts of Mr. Machado's case, as required by law.From Bloomberg, October 4

Secondly, IndyMac (now called OneWest Bank) no longer owned the loan—a group of investors in a securitized trust managed by Deutsche Bank did. Determining that IndyMac didn't really have standing to foreclose, a judge threw out the case and ordered IndyMac to pay Mr. Machado's $30,000 legal bill.

Citigroup Inc. and Ally Financial Inc. units were sued by homeowners in Kentucky for allegedly conspiring with Mortgage Electronic Registration Systems Inc. to falsely foreclose on loans. The homeowners claim the defendants filed or caused to be filed mortgages with forged signatures, filed foreclosure actions months before they acquired any legal interest in the properties and falsely claimed to own notes executed with mortgages.Video from NBC Nightly News, October 1

http://www.mefeedia.com/video/33073666

Calculatedrisk blog:

http://www.calculatedriskblog.com/2010/10/nightly-mortgage-mess.html

Nakedcapitalism has posted several entries regarding this topic. Here's just one entry:

Lender Processing Services, a crucial player in the residential mortgage servicing arena, has been hit with two suits seeking national class action status (see here and here for the court filings). If the plaintiffs prevail, the disgorgement of fees by LPS could easily run into the billions of dollars (we have received a more precise estimate from plaintiffs’ counsel). To give a sense of proportion, LPS’s 2009 revenues were $2.4 billion and its net income that year was $276 million.Here's one MSNBC Video on the mess:

I don't do this nasty tale of cutting corners and deception any justice with this overview. Read all the links above for a fuller story.

Tuesday, September 21, 2010

Shadow inventory: More homes coming

I have spoken before about how the supply of forced sale (foreclosed or short sale) inventory continues to increase but may be close to peaking. Here's an article stating the peak is not yet in and we have more to come:

From Realestatechannel comes some rather scary data regarding how the pipeline continues to be filled and they see no let up on new supply being dumped on the market.

ht: PragCap

From Realestatechannel comes some rather scary data regarding how the pipeline continues to be filled and they see no let up on new supply being dumped on the market.

If this were early 2005, one could claim that 40% of homeowners who were delinquent 90 days or longer would eventually bring the mortgage current. But the cure rate has plunged along with home prices. As early as one year ago, the cure rate had dropped to almost zero. A delinquency of 90+ days now means almost certain foreclosure or short sale.

. . . To come up with a total for the shadow inventory, let's first add the total number of loans in default to those delinquent 90 days or more since we know that these loans are headed for foreclosure or a short sale. That comes to 4.5 million properties. Based on the cure rate for loans delinquent at least 60 days, we will add 95% of those 60-day delinquencies. That is an additional 723,000 residences. For the same reason, we will add 70% of those delinquent for at least 30 days - 1.25 million properties.

And, of course, let's not forget the REOs that have not yet been placed on MLS listings by the bank servicers. We'll be conservative and estimate them at 500,000. Adding all of these together, we come up with a total of roughly 6.97 million residences which are almost certainly going to be thrown onto the resale market as distressed properties at some point in the not-too-distant future. This massive number of homes will put enormous downward pressure on sale prices. To believe that prices are firming now is to completely ignore this shadow inventory. Ignore it at your own risk.I suggest you read the whole article.

ht: PragCap

Monday, September 20, 2010

One small facet of the the mortgage mess

NPR (National Public Radio) has a great ongoing series about the mortgage mess. As a centerpiece to the series they purchased a slice of one very sick package of mortgages and are investigating the mortgages inside it. So far they have found some serious mortgage fraud as well as some other interesting stories. Take a look at one small facet of the housing bubble:

NPR: Planet Money's Toxic Asset

ht: NicTrades

NPR: Planet Money's Toxic Asset

ht: NicTrades

Monday, August 30, 2010

The Fed is exacerbating the move in bonds

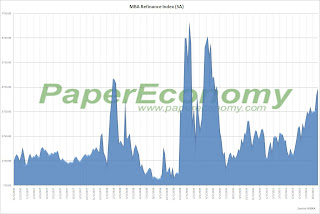

The recent Federal Reserve August 10 announcement to reinvest principal paydowns from its very large (1+ Trillion) mortgage backed security portfolio into longer dated US Treasury securities is providing additional downward pressure on home loan rates.

Because interest rates have dropped since the completion of purchases, (March 31,2010: Federal Reserve MBS Faq) the frequency of individual homeowners refinancing has gone up. As such cash flows back to the Federal Reserve have increase to a rate higher than initially expected.

If you look at the first chart attached you can see 10 year bond prices were already marching higher before the Federal Reserve reinvestment announcement of August 10. (Shown here as a white vertical line) Since then they have continued higher.

These principal payments are being invested in longer term Treasury Bonds which then pressures long term interest rates down, causing more refinancings, causing more cash to be sent to the Fed which then buys more Treasury bonds. Do you see the pattern here? This does not mean long bond yields WILL drop, but it places additional pressure for them to go down until the current refinancing burst (Paper Economy) ends.

I wonder if the Fed thought this all through?

Because interest rates have dropped since the completion of purchases, (March 31,2010: Federal Reserve MBS Faq) the frequency of individual homeowners refinancing has gone up. As such cash flows back to the Federal Reserve have increase to a rate higher than initially expected.

If you look at the first chart attached you can see 10 year bond prices were already marching higher before the Federal Reserve reinvestment announcement of August 10. (Shown here as a white vertical line) Since then they have continued higher.

These principal payments are being invested in longer term Treasury Bonds which then pressures long term interest rates down, causing more refinancings, causing more cash to be sent to the Fed which then buys more Treasury bonds. Do you see the pattern here? This does not mean long bond yields WILL drop, but it places additional pressure for them to go down until the current refinancing burst (Paper Economy) ends.

I wonder if the Fed thought this all through?

Subscribe to:

Comments (Atom)