I'm sure I won't surprise any of you by mentioning home prices are high right now, really high.

The COVID combination of a desire to work from home and the massive federal money dump worked in tandem to stimulate purchases just as the pipeline of new homes paused due to the global supply chain shutting down. It was a nasty combination which increased prices to the highest year over year increase on record.

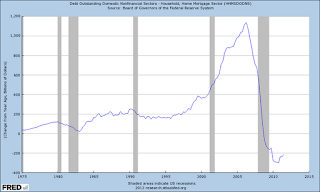

The inflationary spike which followed the above mentioned money dump inevitably forced inflation higher, along with mortgage rates to levels not seen in more than two decades.

Please examine the following images to get a sense of the massive dislocation we've just experienced.

Home prices went zoom! during COVID (Source: Federal Reserve)

Increase the money supply too much and you get inflation.(Source: Federal Reserve)

Mortgage rates not seen since the early 2000's (Source: Federal Reserve)

With the rise in home prices and mortgage rates the affordability of homes declined dramatically. The median home payment shot up from <$1,200 a month to over %2,000, an increase of more than 60%

Affordability and median payment. (Source: Haver Analytics)

While these are national averages there is little opportunity for local conditions to push against such a strong current. New home sales have slowed and the inventory of homes for sale has ballooned. We are in a situation usually only seen during recessions.

Monthly supply of new home sales (Source: Federal Reserve)

New home sale prices have already rolled over while composite home index has not. Eventually these two indices will converge.

New Home versus all home price index year over year change (Source: Federal Reserve)

Home price declines are rare on a national level, looking back at the 2000 recession you can see they didn't fall, it was only during the Great Recession of 2008 where we had a sustained decline in home prices. I'm not predicting such an event again but the excess number of new homes for sale will need to return to equilibrium somehow, either through reduced prices or a reduction in new home production. Either one (or both) will stress the economy via a reduction in homeowner's equity or additional layoffs in the new home construction complex.

We are already starting to see a slowdown in total construction spending, not just homes. Again, we are in recession territory with these sorts of numbers.

You may notice a theme with the tone of this post. Several construction indices are well within recession territory already despite us not being in a recession right now. Why the disconnect? Is it labor hording post COVID? Are we still seeing aftershocks from the massive money dump during COVID? I'm scratching my head at the disconnect. I have a client who is in the new home construction sector and this one data source tells of increasing discounts and layoffs.

If home prices do decline their impact will ripple through the economy and inflation rates. Shelter accounts for more than 35% of the CPI index. Right now the markets are very worried about an increase in inflation due to tariffs and the new spending bill just signed into law.

edit 08/12/25: I misread the information. "Housing" is actually ~44% of the CPI calculation. Source: bls.gov

I'm not implying or predicting a direction for inflation over the near term, but a trend downwards for inflation instead of the anticipated market upward bias could be a shock to the markets. Keep an eye on the housing market, it may surprise us.