The holiday season bring much cheer, and shopping. In today's modern economy much of that shopping ends up being online with packages delivered to your door. Very convenient, unless they are stolen...

While my primary mission is managing assets for clients I have realized keeping those assets safe, while ancillary, is also something I should assist with as well. With the Great American Shopping Frenzy underway I thought this would be a good time to remind you to keep those packages and letters safe! Here's a few ways to do so:

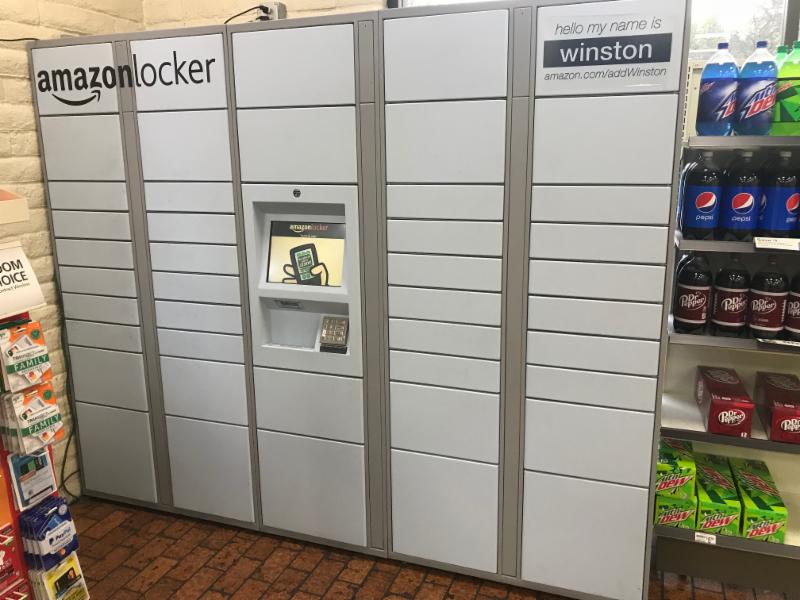

Amazon lockers

I use Amazon, too much most likely, for business as well as personal purchases. It's incredibly easy and very competitive on pricing. Bulk dog food is cheaper from Amazon than my local pet store!

I use Amazon, too much most likely, for business as well as personal purchases. It's incredibly easy and very competitive on pricing. Bulk dog food is cheaper from Amazon than my local pet store!

Shopping via Amazon unfortunately creates an target for porch thieves unless you are careful. Fortunately there are alternatives; Amazon allows one to have your orders delivered to a 'locker' in a nearby store of your choosing.

Here's a link to find a locker near you:

Physical security of mail

If you don't have a secure mailbox, you'll get your mail stolen. It's not a question of when but if. Even something which looks secure may not necessarily be so. Preventing your packages from being stolen may be topical, but getting your mail stolen a year round concern.

Mail theft happened to me several years ago and my solution has prevented any mail theft since. It's a severe response, but look at what a crowbar does to some other options out there

The solution, cold hard steel and lots of it, a quarter inch to be exact. It's probably bullet proof as well, but I'm not going to test it for you.

https://www.fortknoxmailbox.com/product-category/mailboxes/

https://www.fortknoxmailbox.com/product-category/mailboxes/

Shred

Once you've received your documents, make sure they don't leave the house intact. My shredder gets a workout almost every day. All financial and health documents no longer needed get shredded.

It is frustrating to have to alter one's behaviour to prevent crime but it's an unfortunate fact of life. I ask you to learn from my own and other's negative events to keep yourself safe.

Happy Thanksgiving.

Now go eat some Turkey.

Additional links:

Porch pirates stealing your online orders:

Health care fraud: Unfortunately people will imitate you for medical care or for identity theft.

https://www.fbi.gov/investigate/white-collar-crime/health-care-fraud

https://www.fbi.gov/investigate/white-collar-crime/health-care-fraud

Physical security of the home