The Lament of a low risk investor

10 year TIPS rate

source: Federal Reserve

One of the challenges in managing a portfolio during the distribution phase is balancing the conflicting desires of certainty and return. This is the classic risk versus return debate. Higher risk should be rewarded by higher return, with the opposite also true. When you accept a lower risk your return will be lower as well.

When a portfolio shifts to one providing income for the owner, return of principal becomes more important than return on principal. One of the ways I used to provide certainty was the purchase of inflation protected securities from the US government. They provide a guaranteed return over the inflation rate. Well they used to, but please read on.

Some of you are already considering not reading further. I'm a stock jockey Greg! I only care and invest in stocks, equities, risky stuff. Why should I care about the ramblings of a manager trying to eke out a return for some grandma? Please endure for a little while, my dilemma affects you as well.

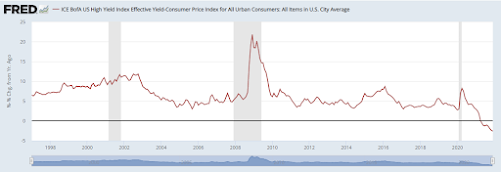

As the chart above shows, nearly two decades ago one was rewarded for giving your funds to the US Treasury for 10 years with a low return of around two percent above inflation. That's not much, but remember, we are looking for the money to be there when it matures; security first, return second.

Some of you may reply the official inflation numbers are incorrect, and I would say you may be correct in this assertion. Inflation for a person in their 20's is very different than one in their 80's. The mix of products and services required of a retiree are very different from that of a young adult. Furthermore there is debate if the basket of products is properly measured at all. I don't wish to make this article a discussion about the accuracy of government statistics so for those disagreeing please concede to me that this is the measurement I have, and these securities' returns are based upon that measurement. It's the best we have right now.

Around the great recession of 2008 I started purchasing these 10 year securities at auction, slowly building up a small laddered position for those in the distribution phase of life. The goal was to have a laddered portfolio of these maturing every six months. I grumbled at the returns but knew their utility, a safe but low return security that would form the foundation of a clients' portfolio. (There is an ETF doing effectively the same. The symbol is TIPX)

Notice on the graph above how real yields dropped to below zero around 2012. While I was willing to accept a low real return, a negative real return was not acceptable.

Now consider this please, dear reader. Why would you voluntarily hand the US government your funds for 10 years with the guarantee of a loss after inflation? (and taxes if you don't place them in a Roth IRA) Yes, traders may want to buy them in order to profit from the price changing day to day, but I am holding these to maturity.

I paused the purchases during this negative period and restarted when rates were again positive.

Which brings us up to today. 10 year TIPS rates are quite negative and have been so since the COVID scare of early 2020. As you may guess, I have stopped buying TIPS of any sort.

I doubt the US government has noticed the lack of my purchases, but I'm not the only one who has noticed you are handing your money away for 10 years of punishment.

Why

do I bring this up? Because other purchasers with a low risk mandate will have come

to the same conclusion. Why should I buy

something that guarantees me a loss? Those buyers, like myself, will start to

look elsewhere for returns.

Are there alternatives for the low risk investor? Well not really.

There are I Bond savings bonds from the US Treasury. The purchase of which is somewhat involved and are currently offered at a rate of 0, which means you will receive the inflation rate. It's not a positive return, but at least it's not negative like the current 10 year tip rate. There are exit fees if you redeem them early however. Please read up and consider the negatives before you purchase them.

How about longer term US Treasury bonds? Well, same problem. Negative real return, on top of adding quite a bit of duration risk

Hmm. Perhaps high yield bonds? Switch from duration risk to credit risk? Same issue, return is negative on a real yield basis.

So you can hopefully see the quandary. There is no place to squirrel money away and not get punished for it. This should violate the risk / return idea I highlighted at the beginning. I am willing to part with some funds for 10 years but right now I'm punished if I do so. So what to do....

That comes later, but for now realize the situation we are in and realize individuals and institutions are responding.

As for the stock jockeys who managed to continue reading, realize the negative real rates affects your stock returns. As the discount rate falls to a negative number this naturally inflates the value of stocks. Why is the

CAPE ratio in the stratosphere? Earnings are being discounted by a much lower number, raising their present value. The movement of US Treasury interest rates affect the value of your assets as well so it behooves you to watch them.