While oil prices have not done much recently total oil product inventories have been creeping upwards in America and throughout the rest of the OECD.

Looking at total US oil and petroleum products inventory levels you will see they are at 20 year peaks! The OECD is also above its 5 year average inventory levels.

So if the industrialized world is filling up with oil where is it all going and why have prices not dropped? Some possible reasons are:

* Emerging market demand and specifically China is a great unknown.

* The Iran / Israel situation is keeping people jumpy.

* The financialization of commodities also provides a firm bid on oil prices.

* Hurricane season is just warming up in the US. We'll see how much carnage they produce.

Here's some previous entries on the topic of hurricane season:

http://merrillovermatter.blogspot.com/2009/08/weather-and-oil.html

http://merrillovermatter.blogspot.com/2009/09/so-far-no-hurricanes-this-year.html

Tuesday, September 7, 2010

Monday, August 30, 2010

The Fed is exacerbating the move in bonds

The recent Federal Reserve August 10 announcement to reinvest principal paydowns from its very large (1+ Trillion) mortgage backed security portfolio into longer dated US Treasury securities is providing additional downward pressure on home loan rates.

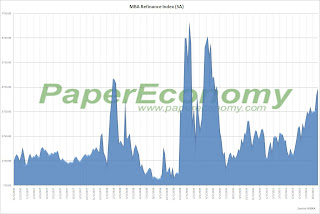

Because interest rates have dropped since the completion of purchases, (March 31,2010: Federal Reserve MBS Faq) the frequency of individual homeowners refinancing has gone up. As such cash flows back to the Federal Reserve have increase to a rate higher than initially expected.

If you look at the first chart attached you can see 10 year bond prices were already marching higher before the Federal Reserve reinvestment announcement of August 10. (Shown here as a white vertical line) Since then they have continued higher.

These principal payments are being invested in longer term Treasury Bonds which then pressures long term interest rates down, causing more refinancings, causing more cash to be sent to the Fed which then buys more Treasury bonds. Do you see the pattern here? This does not mean long bond yields WILL drop, but it places additional pressure for them to go down until the current refinancing burst (Paper Economy) ends.

I wonder if the Fed thought this all through?

Because interest rates have dropped since the completion of purchases, (March 31,2010: Federal Reserve MBS Faq) the frequency of individual homeowners refinancing has gone up. As such cash flows back to the Federal Reserve have increase to a rate higher than initially expected.

If you look at the first chart attached you can see 10 year bond prices were already marching higher before the Federal Reserve reinvestment announcement of August 10. (Shown here as a white vertical line) Since then they have continued higher.

These principal payments are being invested in longer term Treasury Bonds which then pressures long term interest rates down, causing more refinancings, causing more cash to be sent to the Fed which then buys more Treasury bonds. Do you see the pattern here? This does not mean long bond yields WILL drop, but it places additional pressure for them to go down until the current refinancing burst (Paper Economy) ends.

I wonder if the Fed thought this all through?

Wednesday, August 25, 2010

Refinance your home if you haven't done so already

Now is a good time to consider refinancing your home if you have not done so already. As you can see from this graph mortgage rates are at generational lows. The recent decline in long term rates was a 'surprise' to the markets but not unanticipated by some. (Clients please look at your account statements.)

The Wall Street Journal had a recent article about shopping for a home loan:

If you are in the position to refinance and have questions give me a ring and we can talk about some of the options / pitfalls when looking for a new mortgage.

The Wall Street Journal had a recent article about shopping for a home loan:

The interest rates for 30-year fixed-rate mortgages are in free fall, averaging just 4.44% on Aug. 12, according to Freddie Mac. Not only was that down from 5.07% in January, it was the lowest since Freddie began keeping records in 1970.As the article mentioned some very good deals can be found at smaller banks and credit unions. Our family's primary checking account is at a credit union and their excellent customer service and low fees are a stark contrast to the national chains.

But even better deals can be found at smaller banks and credit unions.

"I've found that my clients can get routinely better rates by heading to a more regional lender and forgoing the bigger lenders," says Sean Satkus, a real-estate agent in the Washington, D.C., area.

The differences can be stark. On average, the three biggest banks—Bank of America Corp., Wells Fargo & Co. and J.P. Morgan Chase & Co.—offer rates of 4.66% on 30-year fixed mortgages for home purchases, according to Bankrate.com. By contrast, St. Louis's Heartland Bank is offering a rate of 4.50%. Acacia Federal Savings Bank comes in at 4.25%. And Rockland Trust Co. in Boston is offering just 4.13%. (None of these offers include "points," or extra fees to secure lower rates.).

If you are in the position to refinance and have questions give me a ring and we can talk about some of the options / pitfalls when looking for a new mortgage.

Monday, August 23, 2010

Greek bond yields keep crawling higher

Greek 10 year bond yields are creeping higher again. I don't know if 'creeping' is the best word considering their volatility over the last year but you be the judge. The 10 year closed at 10.91% today.

You can see the spike to 12+% and then rapid decline in May when the 750+ billion Euro bailout package was announced.

Since then rates have started climbing again. I wonder what will happen when rates climb above their pre-bailout levels?

You can see the spike to 12+% and then rapid decline in May when the 750+ billion Euro bailout package was announced.

Since then rates have started climbing again. I wonder what will happen when rates climb above their pre-bailout levels?

Thursday, August 19, 2010

Seasonality and the Baltic Dry Index

I'm doing some research on other economic indicators showing seasonality for a later post. An article on the BDI (Baltic Dry Index) and how shipping rates show a seasonal tendency caught my eye.

From the Financial Times:

From the Financial Times:

It is with interest, therefore, that we note Icap’s latest monthly shipping report — which errs towards the notion that the move wasn’t necessarily so unusual.As you can see from the graph from Stockcharts the BDI can be ... volatile.

According to the broker, for example, the BDI has fallen in June on 20 separate occasions since 1985 — making the recent declines relatively consistent.

As they noted:

..no other month can claim to have such a poor track record, although the month of July has shown a similar tendency towards weakness over the years.

It's important to know if a data series contains seasonal affects to it. That's one reason I tend to show data on a year over year format which eliminates time of year influences.

Wednesday, August 18, 2010

Money Money Supply -- Money supply update.

A money supply update. The data presented includes both the M2 money supply and the only remnant of M3 still published by the Federal Reserve which is Institutional Money Market Funds. Together this is the 'broadest' measure of money supply published by the Federal Reserve.

A money supply update. The data presented includes both the M2 money supply and the only remnant of M3 still published by the Federal Reserve which is Institutional Money Market Funds. Together this is the 'broadest' measure of money supply published by the Federal Reserve.As you can see money supply continues contracting which has not happened for the entire data series starting back in 1974. The previous slowdowns around 1994 and 2005 did show declining growth rates but this absolute decline on a year over year basis is unique.

The Fed needs to take some lessons on how to make money:

Tuesday, August 17, 2010

China lending update. Is bank lending speeding up or slowing down?

It has been a while since I have updated you on the bank lending situation in China. This is not due to me slacking off (I'll admit to a slower pace of posts recently, but I have some good excuses, really) following this topic. The data source, People's bank of China, has suddenly been a little more reticent in publishing this data in English and as my Chinese language skills are a bit lacking this data series has languished....

Data released recently shows a continuing trend of official slowing in the rate of loan growth. I put official in italics because there appears to be some off balance tomfoolery going on. . .

From Caixin Online:

If you are wondering where all that money is going, this blog entry by staff at the World bank is stunning. Not only for the information presented but the absolute lack of surprise. (ht Mish)

Data released recently shows a continuing trend of official slowing in the rate of loan growth. I put official in italics because there appears to be some off balance tomfoolery going on. . .

From Caixin Online:

Despite regulatory directives aimed at preventing banks from removing loans off their balance sheets to dodge credit restrictions, China's banks did not slow down their pace in packaging loans as wealth management products.[The 4.58 trillion yuan number matches my data. Look at the 'wealth management products' value of 2.6 trillion. Greater than 50% of the 'on the books official' value of 4.58 trillion. Continuing . . ]

Banks and trusts cooperated on wealth management products, effectively allowing them to shirk their responsibilities toward credit limits imposed nationwide under the central government's macroeconomic controls.

In the first half 2010, according to trust company reports, the value of wealth management products cooperatively offered by banks and trusts rose to 2.6 trillion yuan, topping the previous year's 1.77 trillion yuan.

This amount combined with the 4.58 trillion yuan in on-the-books, new credit issued by banks in the first half brought total lending in China through June 30 to near the 7.5 trillion yuan limit set by the government for all 2010.

By charging fees as well as commissions of up to 2 percent, banks earn more than trusts when they jointly market bank-trust products. Moreover, by cooperating with trusts, banks keep customers otherwise unavailable due to credit controls, since off-book business doesn't require bank capital and thus avoids CBRC capital constraints.When companies start hiding assets off balance sheet it rarely ends well.

If you are wondering where all that money is going, this blog entry by staff at the World bank is stunning. Not only for the information presented but the absolute lack of surprise. (ht Mish)

In Chenggong, there are more than a hundred-thousand new apartments with no occupants, lush tree-lined streets with no cars, enormous office buildings with no workers, and billboards advertising cold medicine and real estate services – with no one to see them.I went to China in 2003 and I can assure you I NEVER saw a single piece of urban pavement that was not completely full of cars, trucks, bikes, scooters, etc at all times. I have mentioned empty Chinese cities before such as Ordos. How many more empty cities in China are there? Andy Xie has wrote about this before. Here is his latest article regarding the excess housing stock in China:

What distinguishes China’s property bubble from others is its unprecedented quantity dimension. China just doesn’t have any constraint limiting supply. The current debate about the quantity of empty flats is about the extent of quantity excess. The stock of empty flats measures the size of the quantity bubble. Taiwan experienced a price-cum-quantity bubble in late 1980s. At the time the market quantified the number of empty flats by obtaining data from the electricity supplier on flats without usage of electricity. The stock of empty flats measured this way was about 15% of the total households. Some analysts are trying the same tactic to quantify the volume of empty flats in China. The problem with this methodology is the complexity of China’s housing conditions. . . . While the data are not accurate, we can confidently conclude that China doesn’t have absolute housing shortage and the per capita space is above Europe and Japan’s level. Indeed, if we adopt Japan’s standard, China already has sufficient urban housing space for everyone in the country, i.e., there is housing for every person in the countryside to move into city. . . Four unique factors may explain China’s unique phenomenon.When this bubble goes pop you better have some popcorn and a good seat because the explosion will best any action film explosion sequence.

1) Sustained negative real interest rate has led to declining demand for money and rising appetite for speculation. Greed and fear of inflation are working together to form unprecedented speculative demand for property.

2) The massive amount of gray income looks for a ‘safe’ haven. China’s gray income of various sorts could be around 10% of GDP. In an environment of rising inflation and depreciating dollar-the traditional safe haven, China’s rising property market is becoming the preferred place for this money.

3) China’s masses have no experience with property bubble. The property crash in the 1990s touched a small segment of the society. Foreigners and state-owned enterprises were involved. Geographically, it was restricted to Southern freewheeling zones like Hainan and Guangdong and Shanghai. Most people in China don’t know that the country had a property crash. Lack of fear is turbo-charging the greed.

4) Speculators believe that the government won’t let property price fall. They correctly surmise that local governments all depend on property for money and will try every effort to prop up its price. But, their faith in the government omnipotence is misplaced. In the end, market is bigger than government. Government behavior can delay, not abolish market force. Nevertheless, this faith in government is removing the fear over the downside. Hence, the speculative demand just grows with credit availability unchecked.

Subscribe to:

Comments (Atom)