Before continuing with my posts on oil and energy I'd like to call out two excellent sources of information. I've used both in my research and while I attempt to source everything sometimes bits of it slips through into the zeitgeist of my ideas and isn't directly referenced.

http://soberlook.com/ and more specifically his Daily shot email list is an excellent publication on the current financial markets. He is also on twitter at @SoberLook

John Kemp is an energy market journalist at Reuters. He also provides frequent emails specifically on the energy markets. Email him at john.kemp@thomsonreuters.com and request to be added to his email list. He is also on twitter at @JKempEnergy

Ok, back to it....

In my earlier communication I discussed some possible reasons why oil prices dropped so dramatically. Now we'll consider why they will rise, eventually. I'll keep this one 'bullish' and save the horrifically bearish counterpoints for the next installment.

There's a common pithy statement which is the theme of this post -- The solution for low prices is low prices

Low prices encourages demand

The economy has not roared back to life in the last 12 months but the pain at the pump sure has gone down. Lower prices are encouraging people to drive more.

Low prices destroys investment in new supply

Energy extraction is a very capital intensive business and the decline in prices has already reduced investment, either voluntarily or involuntarily

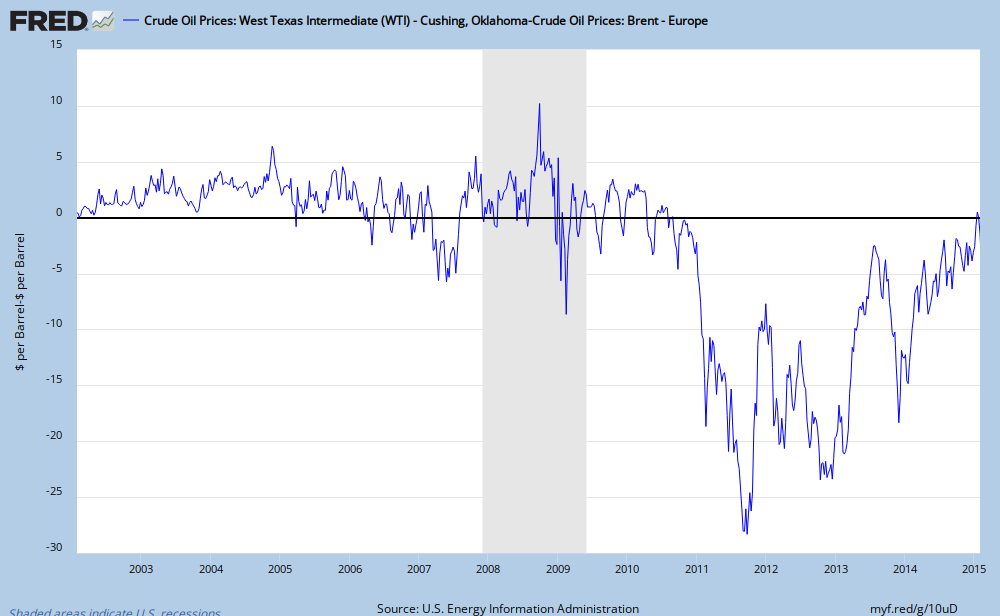

This chart is very instructive in showing how investment (like drilling, see below) in the energy business chases the price.

As much as 400,000 barrels a day of oil production is at risk as U.S. shale companies like Samson Resources Co. run out of money and are forced to slow drilling.

Natural decline in fields

Conventional fields decline around 5% a year; shale fields drop much faster, 50%+ the first year, with the rate of decline lower in later years. Assuming just a 5% decline rate in oil production from current oil fields you need to replace the entire oil production of Canada each year. Yes, there is excess capacity now and new projects coming online, but the dropoff in new field investments will eventually overwhelm that spare capacity.

Drilling rig count continues to plummet, not only in the US but worldwide

New wells require new drilling, and new drilling activity is plummeting. As of October 2015, the year over year percentage decline is a stunning 42% Current data as of 02/8/16 shows this trend continues:

Comparing drilling rig activity and oil prices one can see how drilling activity 'chases' the oil price. Higher oil prices increases drilling activity and vice versa.

thanks to: @MaxCRoser

One must be careful thinking this means a 42% reduction in wells dug or initial flow rate. Drilling rigs have become frightfully effective over the last few years in US / Canada. A recent email from RBN energy provides examples of this stunning increases in total productivity.

These improvements are at Moore's law level of technology gains in the energy sector. A 428% gain in initial production productivity over four years is stunning. This massive increase in efficiency is something I'll come back to in the next missive.

Political Chaos

Harder to predict but considering the number of countries derive a high percentage of their GDP or federal budget from oil / natural gas revenues, something is bound to break at these prices.

Please click around on the link above and observe how many countries depend upon petroleum products for a very large portion of their revenue, and right now they are hurting! Some have a massive kitty to draw upon but the rest, not so much.

Here's a quick rundown of a few countries hit by the drop in oil prices.

Venezuela - a horrid situation made worse by the drop in petroleum prices. In my opinion it will be the first domino to fall

Econimic basket case - http://www.bbc.com/news/world-latin-america-34983467

Change in government - http://www.bbc.com/news/world-latin-america-35043945

Economic collapse - https://www.washingtonpost.com/news/wonk/wp/2016/01/29/venezuela-is-on-the-brink-of-a-complete-collapse/

Brazil

Recession - http://www.economist.com/news/americas/21665038-shrinking-once-vibrant-economy-shocking-ordinary-folk-well

Russia

Recession - http://www.wsj.com/articles/world-bank-downgrades-russias-economic-outlook-1443609118

Saudi Arabia

The Saudi's are running out of money.

At a burn rate approaching 100 billion dollars a year they do have a couple of years breathing room, but what about the other OPEC nations? The House of Saud is considering selling bonds to plug the gap, but this only buys them time.

While some of the OPEC nations can handle low oil prices for years the majority cannot

Source: The Daily Shot

(Future) Loss of Power

This may be a bit abstract but work with me here for a bit. It may be causing fiscal and political problems at home but right now OPEC, and Saudi Arabia specifically are crushing their competitors and destroying future production prospects in other countries. There just aren't enough projects to make up for the 5+% percent a year decline in the world's oil wells.

Right now the best estimate is OPEC has ~2 million barrels/day of spare capacity.

Saudi Arabia is the largest OPEC producer and has historically provided quite a bit of swing capacity to modulate the price of oil (see above link for additional details) What happens if perchance OPEC succeeds and is able to completely demolish the US shale business as well as other non-OPEC production and they are running flat out producing oil?

Do they now 'control' the price of oil? NO. They are just like every producer out there, maximizing production. So I ask you in my hypothetical situation: How low would the next president of the United States bow to the king of Saudi Arabia? Without spare capacity Saudi Arabia loses a very important lever of power. In some ways this is analogous to a quote from Dune.

Will Saudi Arabia declare victory, reduce production, and regain the ability to raise and lower the price at will?

War

Yemen

The war in Yemen doesn't get as much attention as it should

Syria, Isis, Turkey, Russia, the Kurds, etc

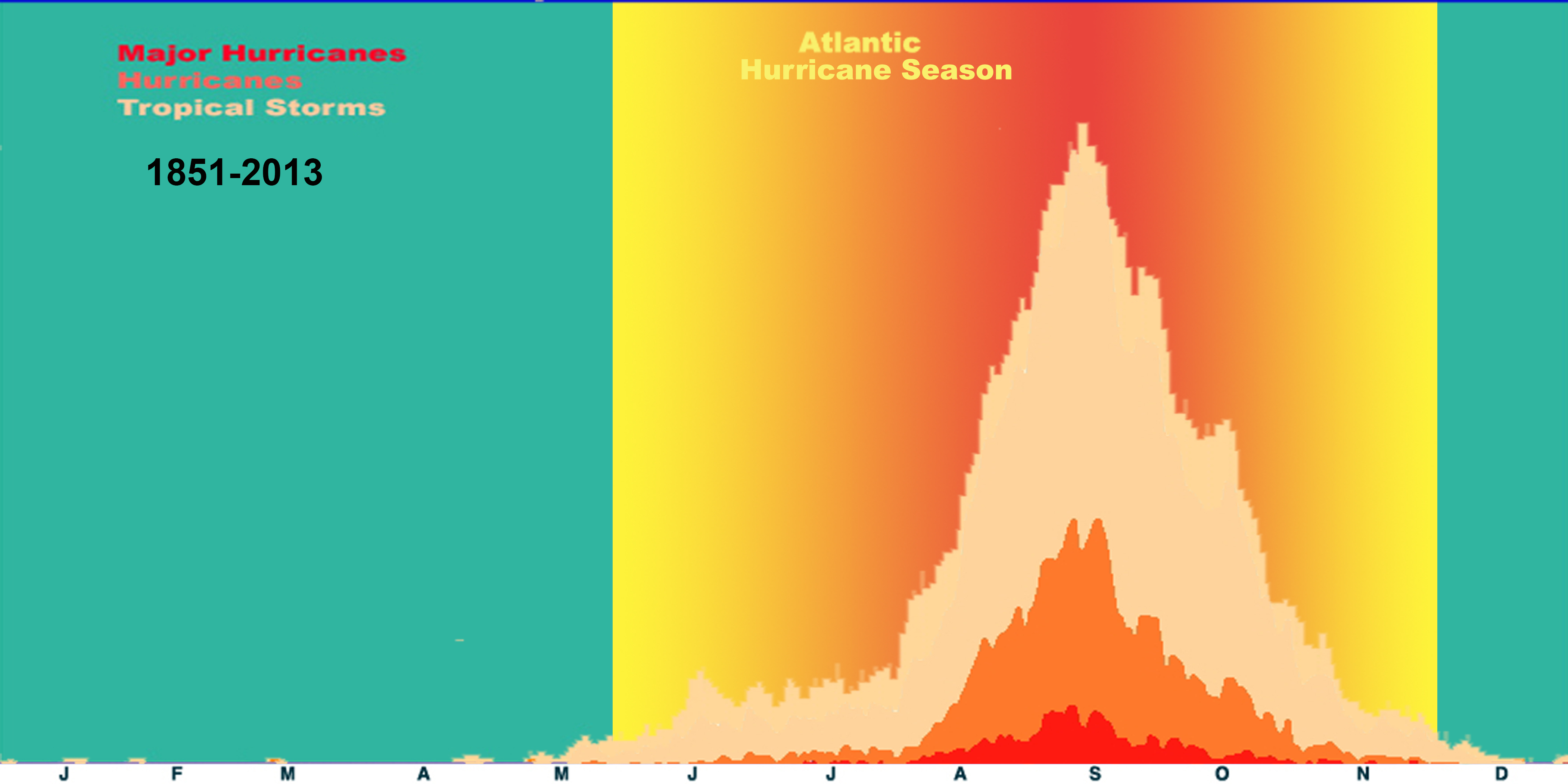

I can't even keep up with all the various sides and their motivations. It's a big fat nasty cruel mess. However, with all the ordnance flying around it could trigger something much much worse and blow up an oil field or two.

The geopolitical struggles of Russia, Iran, and Saudi Arabia are being played out in the energy markets as well on the battlefield. How, when, or if they will eventually set aside enough of their differences to agree to a cut in production is something I cannot predict, but the inevitable decline in current production will inexorably reduce the excess supply in the markets.

Next I'll try to list some of the factors as to why there's so much bearishness in the oil markets today; add it all up and there's not a pleasant looking horizon for oil producers.