|

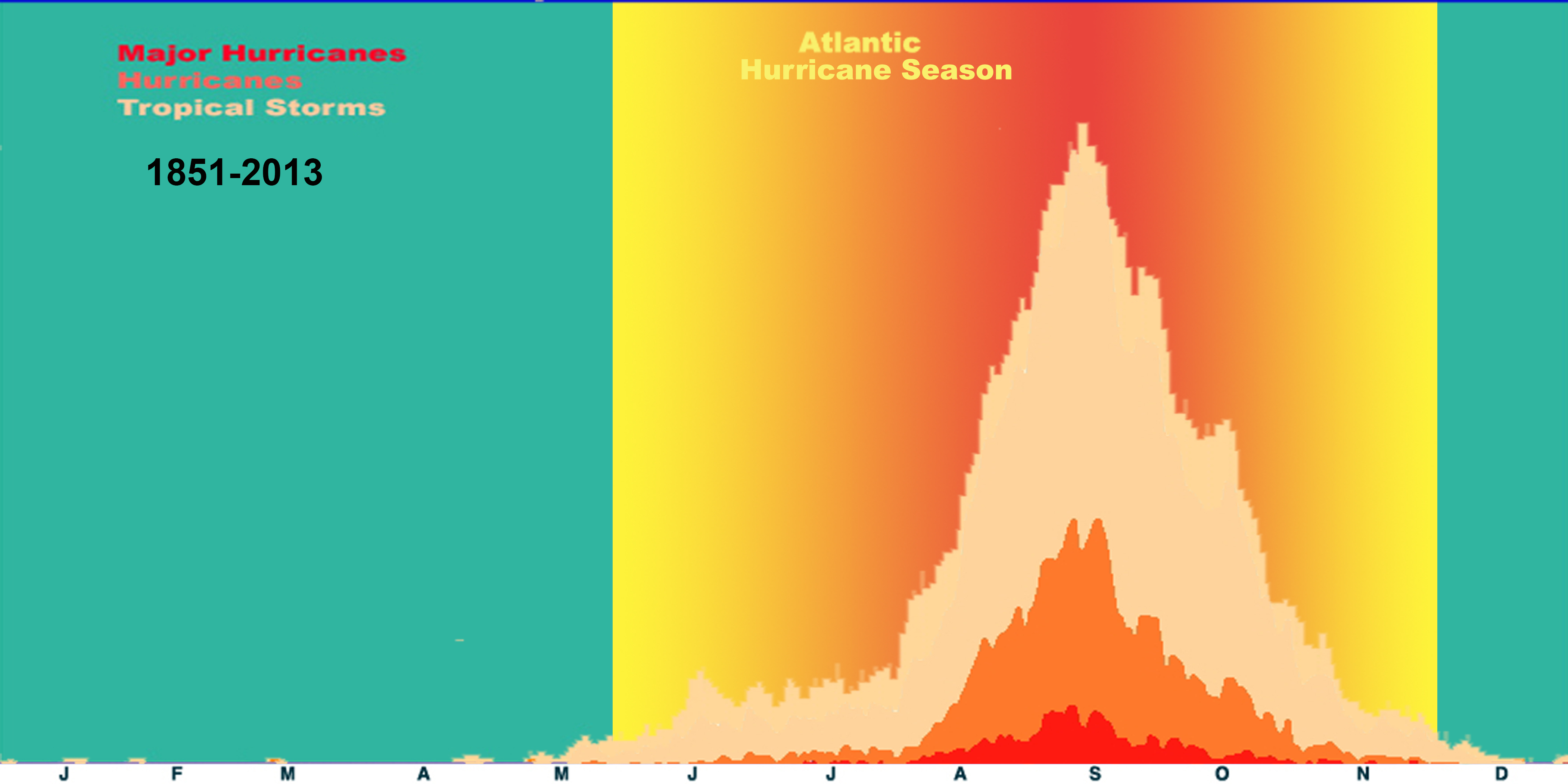

| Atlantic hurricane frequency - source: NOAA |

As of right now the coast does look rather clear except for one storm named Humberto near Africa. The current forecast is for it to rise to hurricane force winds and then fall back to a tropical storm. One can keep an eye on any storms forming at http://www.nhc.noaa.gov/ During hurricane season I open this window every day to see if anything is forming on the horizon.

Beyond the horrible damage, death and destruction a hurricane inflicts upon society they also play havoc with a portfolio. Reinsurance firms, oil service companies, oil and natural gas exploration firms, and even utility companies are but a few of the sectors which can be adversely affected by one slamming into America. Keep an eye out for upcoming storms and also consider stress testing your portfolio. If a major hurricane hit the East Coast how would it affect your portfolio? Do all your energy stocks have Gulf of Mexico fields? What's the risk with your insurance firms, reinsurance firms?

Disclosure: Own stock in pipeline companies, reinsurance, oil service, and major oil & nat gas companies

Edit: Reuters also notices the lack of meteorological violence this year

No comments:

Post a Comment