The Polar Vortex winter dramatically drew down natural gas stocks as the numerous cold fronts worked their way through America. While a decline is natural gas inventories is expected each year, this year America ended the winter with dramatically less natural gas in inventory.

US Natural Gas inventories - via the US EIA

http://ir.eia.gov/ngs/ngs.html

As of the most recent report, inventories are 40.1% below their 5 year average. To graphically show what this means going forward, here's an estimation of how much needs to be injected into storage every day until the maximum fill date date of November 11th.

The 2014 line is the one much higher than the rest. Note how the 2012 line was the lowest, when we experienced extremely low prices.

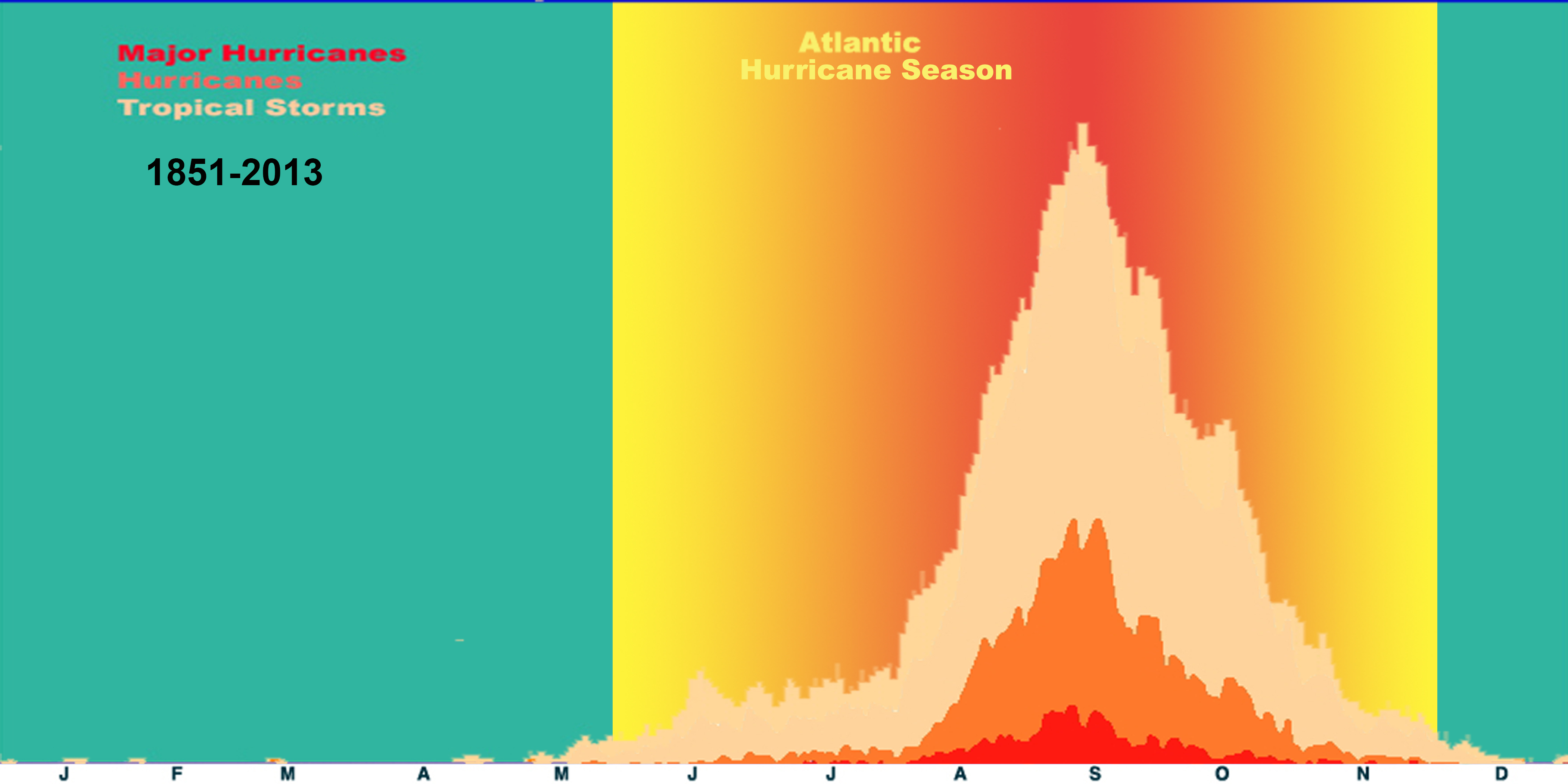

While it's always a guess as to when we'll hit the maximum in storage each year, (going back 19 years the average date was November 11th with a standard deviation of 9.5 days) it is quite apparent this year is unlike many others in recent history. Injecting ~40% more each day looks like a challenge which will not be overcome. Injection rates depend upon the increased production, weather, industrial activity, hurricanes, and I'm sure a few other factors I have forgotten.

IF we get a nasty hurricane barreling through the gulf, a hot summer, or an early cold winter we could have some serious inventory problems in early 2015.

I am not attempting to estimate how much natural gas will be in the ground for this coming winter but it is something to watch this summer.

.jpg)