Another dump of energy articles, questions, etc.

Will big oil charge ahead while smaller E&P's face liquidity issues?

http://on.wsj.com/1KsPoya via @liamdenning

The huge energy companies may be able to power through this downfall assuming prices start rising and they can swoop in and gobble up some low priced assets in the wake of the collapse.

Productivity improvements in oil and nat gas production have been very impressive over the last few years so looking at rig counts over a long time period have lost their efficacy.

https://rbnenergy.com/getting-better-all-the-time-productivity-improvements-crude-production-and-moores-law

Great post on the recent improvements

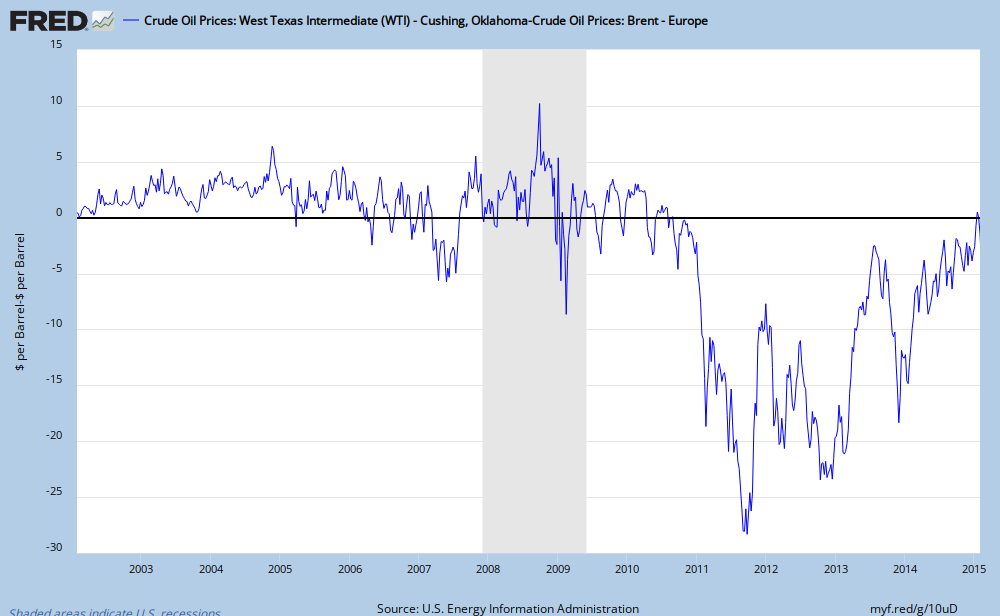

World versus US oil prices

http://research.stlouisfed.org/fred2/graph/?g=10uD

For a while US (WTI) prices separated quite dramatically from world prices (BRENT) Will this recur in the future? The spread helped US refiners earn outsized profits.

Will the Keystone pipeline ever get built?

http://seattletimes.com/html/nationworld/2025244144_pipelineeconomicsxml.html

We may see instead a pipeline going east / west in Canada. The oil must flow!

http://bigstory.ap.org/article/canada-oks-oil-pipeline-pacific-coast

Crude oil shipped via rail has exploded over the last few years. Will this trend continue?

https://www.aar.org/data-center/rail-traffic-data

Did oil shipments crowd out coal shipments? And will the coal finally get to the power plants?

Another article on floating storage