The recent Federal Reserve August 10 announcement to reinvest principal paydowns from its very large (1+ Trillion) mortgage backed security portfolio into longer dated US Treasury securities is providing additional downward pressure on home loan rates.

Because interest rates have dropped since the completion of purchases, (March 31,2010: Federal Reserve MBS Faq) the frequency of individual homeowners refinancing has gone up. As such cash flows back to the Federal Reserve have increase to a rate higher than initially expected.

If you look at the first chart attached you can see 10 year bond prices were already marching higher before the Federal Reserve reinvestment announcement of August 10. (Shown here as a white vertical line) Since then they have continued higher.

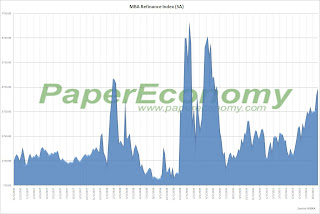

These principal payments are being invested in longer term Treasury Bonds which then pressures long term interest rates down, causing more refinancings, causing more cash to be sent to the Fed which then buys more Treasury bonds. Do you see the pattern here? This does not mean long bond yields WILL drop, but it places additional pressure for them to go down until the current refinancing burst (Paper Economy) ends.

I wonder if the Fed thought this all through?

No comments:

Post a Comment