This appetite for cheap Chinese exports, which had at one point seemed insatiable, means that we in the West have come to owe our largest Asian trading partner quite a hefty sum of money. China has become the world's biggest creditor, after amassing nearly $2.3 trillion of foreign exchange claims on us. However, the spectre of a creditor nation running persistent trade surpluses has ominous historical portents. It has happened only twice before, with the US economy in the Twenties and with the Japanese economy in the Eighties.Read the entire article, it is not long.

Friday, February 26, 2010

Hugh Hendry on China's chronic overcapacity and what it means.

Hugh Hendry once again nails it (in my opinion) as to what China's conversion into the workshop of the world really means.

Thursday, February 18, 2010

Consumer credit keeps contracting faster

Consumer credit data came out about 2 weeks ago and the numbers are not getting any better. Unlike my previous entries showing the very long term I thought I'd zoom in a little to show you how this recession is unlike anything we've seen in the last 40 years. Consumer credit keeps going down and the rate of declining is increasing. Call this an anti-'green shoot'.

The economy will not properly recover and the Federal Reserve will most likely not raise interest rates too much (if at all) until consumer credit and bank lending start rising. Until then, get used to very low short term rates.

The economy will not properly recover and the Federal Reserve will most likely not raise interest rates too much (if at all) until consumer credit and bank lending start rising. Until then, get used to very low short term rates.

Wednesday, February 17, 2010

Bank lending continues falling -- Are buying US Treasuries instead

Bank lending continues to fall on a year over year basis. Compared to the previous two recessions in which bank lending stabilized and then renewed growing this time overall bank lending is down and is continuing to decline.

As you can see from the first graph they are instead following the pattern from the last two recessions and are increasing the US Government securities portfolios while cutting lending to the private sector. Unlike private bank loans Treasuries are very liquid and can be sold immediately if cash is needed. Capital requirements for Treasuries are also much lower compared to a private bank loan. Considering the capital positions of most banks in America (I'll have a post on this soon) are tenuous they need the liquidity and 'safety' of Treasuries.

The year over year change in bank's holdings of US Government securities does not show the full extent of the bank Treasury purchases. As you can see from the second graph the banks continue to load up and the slope is definately upwards.

As you can see from the first graph they are instead following the pattern from the last two recessions and are increasing the US Government securities portfolios while cutting lending to the private sector. Unlike private bank loans Treasuries are very liquid and can be sold immediately if cash is needed. Capital requirements for Treasuries are also much lower compared to a private bank loan. Considering the capital positions of most banks in America (I'll have a post on this soon) are tenuous they need the liquidity and 'safety' of Treasuries.

The year over year change in bank's holdings of US Government securities does not show the full extent of the bank Treasury purchases. As you can see from the second graph the banks continue to load up and the slope is definately upwards.

Monday, February 15, 2010

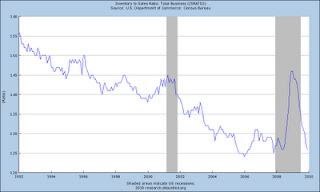

Inventory bounce is pretty much over with

The Inventory / Sales ratio is pretty much back to 'normal'. As such the inventory bounce contribution to GDP is over. A lot of other blogs have the details but here's one picture that says it all.

The quick and easy fixes to GDP growth have already occured. It's going to be tough sledding now.

The quick and easy fixes to GDP growth have already occured. It's going to be tough sledding now.

Friday, February 12, 2010

North Korea from another perspective

Ever since my previous posts on North Korea I have been on the lookout for more articles. The pathology of how the the authorities are able to completely twist and warp the nations reality is fascinating to me. Slate.com ran a recent article:

A Nation of Racist Dwarfs: Kim Jong-il's regime is even weirder and more despicable than you thought.

A Nation of Racist Dwarfs: Kim Jong-il's regime is even weirder and more despicable than you thought.

Consider: Even in the days of communism, there were reports from Eastern Bloc and Cuban diplomats about the paranoid character of the system (which had no concept of deterrence and told its own people that it had signed the Non-Proliferation Treaty in bad faith) and also about its intense hatred of foreigners. A black Cuban diplomat was almost lynched when he tried to show his family the sights of Pyongyang.Interesting reading . . .

Thursday, February 11, 2010

Copper update -- Nice to see I'm not alone in the wilderness

My bearish opinion of copper has been met with (polite) derision by some people. It is nice to see I'm not the only one who is very bearish on the metal

One of the Fast Money members took the very opposite viewpoint from Threlkeld but I find his reasoning incorrect. As I have mentioned in previous posts copper inventories continue to rise and new supply (TCK for example) is coming from various sources.

More on Threlkeld can be found in this Bloomberg article.

I haven't purchased BOS yet. I'm hoping for a bounce from the copper selloff to initiate my position.

One of the Fast Money members took the very opposite viewpoint from Threlkeld but I find his reasoning incorrect. As I have mentioned in previous posts copper inventories continue to rise and new supply (TCK for example) is coming from various sources.

More on Threlkeld can be found in this Bloomberg article.

I haven't purchased BOS yet. I'm hoping for a bounce from the copper selloff to initiate my position.

Wednesday, February 10, 2010

Hugh Hendry debating economists and ambassadors on the Euro and Greece. Loan sharking in the EU.

Hugh Hendry, in the guise of the evil speculator debates Stiglitz and the Spanish ambassador to the UK on the current situation in Greece. The Greek situation is a mess and in my opinion a 'bailout' would create a tremendous moral hazard. Ireland, Spain, and Portugal would all scream foul and demand their own cash / backstop. Only if the bailout includes draconian spending cuts and severe punishment for failure would it actually solve the problem. Considering we are talking about Greece which has a 200 year history of reneging on its debt the odds drop by quite a bit of a sucessful workout.

Even if you could get the Greeks to promise to spending cuts, would they follow through with it? The Germans (presumed donor) could agree to purchase Greek debt ONLY AFTER they cut their budget each and every year until the have a balanced budget. No balanced budget, no more debt buys by Germany. Perhaps the Germans could attach a percentage of EU funds flowing to Greece as their payment source?

Even better, take the title to a few Greek Islands as collateral. Don't pay up, you get an island (or 20 or so)

There's some great commentary afterwards at zerohedge on this debate. Go on over and check it out.

ht Zerohedge

Even if you could get the Greeks to promise to spending cuts, would they follow through with it? The Germans (presumed donor) could agree to purchase Greek debt ONLY AFTER they cut their budget each and every year until the have a balanced budget. No balanced budget, no more debt buys by Germany. Perhaps the Germans could attach a percentage of EU funds flowing to Greece as their payment source?

Even better, take the title to a few Greek Islands as collateral. Don't pay up, you get an island (or 20 or so)

There's some great commentary afterwards at zerohedge on this debate. Go on over and check it out.

ht Zerohedge

Subscribe to:

Posts (Atom)